Journey down memory lane of the U.S. healthcare system to better understand and identify key lessons learned.

The initial issues of this blog will lay a foundation of understanding that will allow us to do a deeper dive into the healthcare-related issues of today and future issues and trends, in order to better position you and your organization to become Winners in the World of Healthcare.

As part of the debate on health policy, there has always been much discussion relating to international comparisons of health systems with specific focus on healthcare costs, quality and access to care. Part of the challenge with these comparisons is that many factors outside the country's health system impact health status including demographics, lifestyle, education, income disparity, etc.

We will address in future blogs some of these issues as we probe further into population health issues and initiatives, but we do have a fundamental question: how did we get here from a health system perspective as it relates to cost, quality and access to care?

To help answer that question, history is a critical tool for understanding the present and preparing for the future. This applies to many fields of knowledge and very appropriately to health care.

Also, in order to best position yourself to be a Winner in healthcare, you will need to have an understanding of the past as well as the Lessons Learned.

Over the next month, we will start our historical journey down memory lane of the U.S. healthcare system using health economics as a framework to better understand and identify the key Lessons Learned. I hope you will enjoy the ride.

--Tom

Lesson Learned: “A healthcare system is shaped by what you pay for and how you pay for it” and, as the largest payer in healthcare, Medicare is the 800 lb. gorilla (the role of the health economics concept of self-interest)

“A healthcare system is shaped by what you pay for and how you pay for it.” A very simplistic concept, but it is so true! I will provide you with a few examples in the hospital setting that illustrate this point, but that would equally apply to other sectors of the healthcare industry.

(Note: I simplified the Medicare payment methodology formula examples below to make them easier to understand.)

Medicare's cost-plus hospital inpatient and outpatient payment methodology ("how you pay for it") (driven by the health economics concept of self-interest)

Imagine you were a hospital chief financial officer during the time period 1965 to 1983. You would be overjoyed with the payment methodology utilized by Medicare and many Blue Cross plans.

Your hospital's major source of income, as it is today, would be Medicare. During this time period, Medicare’s (as well as many Blue Cross plans) hospital inpatient and outpatient payment methodology ("how you pay for it") was cost-plus reimbursement.

Under the cost-plus system of reimbursement, hospitals were paid an amount equal to their costs for treating the Medicare patient, plus a certain percentage above cost for profit and overhead, including infrastructure. Not a bad deal.

Now, let us continue our role playing. As a rational hospital chief financial officer, would you be more or less incentivized to increase expenditures on personnel, infrastructure and technology under a cost-plus reimbursement payment methodology with no risk downside and a guaranteed profit? Obviously, the answer is self-evident, you would be incentivized to aggressively increase your expenditures.

(Note: A valuable lesson learned for the medical device sector as well as other healthcare sectors that look at hospitals as their customers.)

In fact, since your competitors would also be reimbursed in a similar fashion by Medicare, if you did not respond in a like fashion, your hospitals would be placed in a competitive disadvantage, and you would probably lose your job.

Thus starts the medical arms race.

The results by the numbers: "Medicare’s hospital costs under the cost-plus payment system increased dramatically; between 1967 and 1983, costs rose from $3 billion to $37 billion annually.1

Hospital Inpatient Diagnostically Related Groups (DRGs) ("how you pay for it")

In 1983, as a result of these high healthcare costs and their impact on other government priorities (opportunity costs), Medicare implemented a new payment methodology to replace cost-plus reimbursement for inpatient services. The payment methodology was Diagnostically Related Groups (DRGs), and it still exists today.

"The DRG system is a per-case reimbursement mechanism under which inpatient admission cases are divided into relatively homogeneous categories called diagnosis-related groups (DRGs). In this DRG prospective payment system, Medicare pays hospitals a flat rate per case for inpatient hospital care so that efficient hospitals are rewarded for their efficiency and inefficient hospitals have an incentive to become more efficient."

Hospital Inpatient DRGs and Outpatient Cost-plus payment methodologies ("how you pay for it") (driven by the health economics concept of self-interest)

Hospital Outpatient Services:

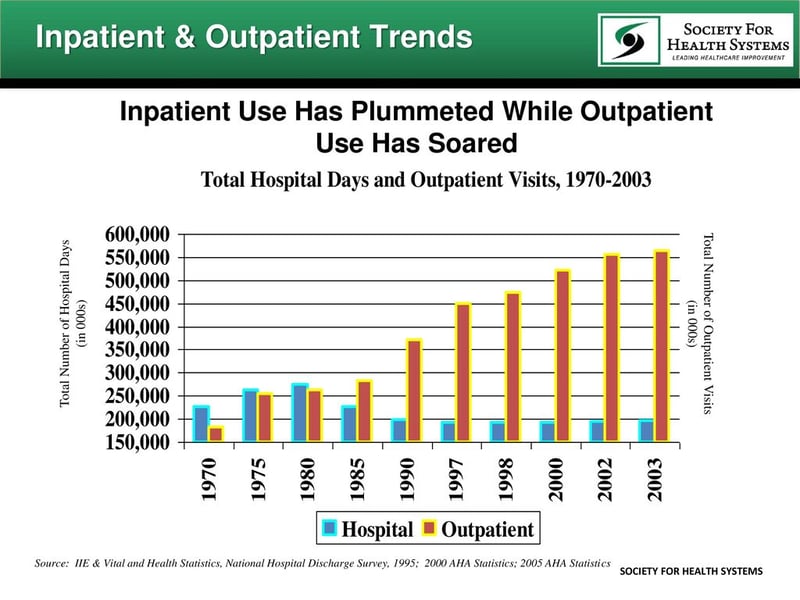

Interestingly, while Medicare switched from cost-plus reimbursement to DRGs for payment of hospital inpatient services in 1983, it continued with cost-plus reimbursement for hospital outpatient services.

Now let's again assume you were a hospital chief financial officer during this time period that hospitals were being paid by DRGs (flat rate) for inpatient services and cost-plus for outpatient services (remember, all outpatient costs involving Medicare patients are covered including related overhead as well as a guaranteed profit), where would you more likely be focusing your resources and initiatives, on the inpatient or outpatient side of the hospital?

If you answered outpatient services, you would be correct. Not that difficult of a question.

Under DRGs, hospitals were financially incentivized to reduce their inpatient length of stay in their efforts to decrease inpatient costs, and as a result of the cost-plus reimbursement methodology, hospitals were financially incentivized to increase their investment in outpatient services and infrastructure.

(Note: A valuable lesson learned for the medical device sector as well as other healthcare sectors that look at hospitals as their customers.)

Additional examples of the Lesson Learned: “A healthcare system is shaped by what you pay for and how you pay for it - Medicare the 800 lb. gorilla" (driven by the health economics concept of self-interest) include:

- Medicare's DRG payment system ignited the growth of inpatient skilled nursing facilities and home healthcare for patients needing additional scaled down health services which were no longer being provided in the hospital setting. (Note: This "how you pay for it" opened up business opportunities for entrepreneurs, especially in the for-profit sector, to aggressively enter the post-hospital market of healthcare.)

- Inappropriate use of high cost technology (We may label it as inappropriate, but guess what, we still pay for it.)

- Inappropriate end-of-life costly efforts (We may label it as inappropriate but, guess what, we still pay for it.) vs. appropriate hospice services

- Lack of focus on preventive services, wellness, etc. (We don't focus on it, because we don't adequately pay for it, especially prior to the ACA.)

- Fewer physicians are pursuing primary care careers (This isn't rocket science. Medical students with large student loans are not incentivized into primary care.)

- Chronic diseases that are not addressed in a coordinated and sustained manner (This is a by-product of a fragmented payment system as well as an electronic medical record that is not linked to all providers of care.)

- Purchasing decisions not based on value (If you are not paid for providing value and there is no financial risk linked to your decisions, you are less likely to make value-based purchasing decisions.)

- We are experiencing a medical arms race (Not a surprise, since historically we have had a fee-for-service payment system for providers based on "the more you do, the more you make.")

- We have a healthcare system that delivers inconsistent quality (The answers are becoming quite obvious. If you want a healthcare system that that is based on consistent quality, you need to pay for it (or not pay for poor quality.)

- The silos within a hospital and outside the hospital still exist (They will continue to exist as long as the dominant payment methodology is "fee for service." If you want positive disruption, you need to have a payment system based on a risk/value-based payment methodology.)

Follow the Leader: Medicare's (the 800 lb. gorilla) payment policies and regulations also impact commercial carriers servicing the under 65 market.

Examples include:

- A large percentage of commercial carriers replicated Medicare's inpatient DRG system and outpatient Ambulatory Patient Categories (APCs). (Note: When I was vice-president of healthcare finance and care management at Blue Cross & Blue Shield of Ohio, our primary payment methodology for hospital inpatient services was DRGs. I guarantee you, even though we were the largest non-governmental payer in the marketplace, hospitals would not have altered their entire infrastructure unless Medicare took the lead with DRGs. The same was true when we rolled out APCs/APGs as a payment methodology for outpatient services.)

- Rather than developing their own unique physician fee schedules, commercial carriers pay providers of care based on a percentage of Medicare's fees

- Commercial carriers' utilization review criteria is greatly influenced by Medicare.

Concluding thoughts and lessons learned: Medicare's influence on our healthcare system - "how we got here" ("what you pay for and how you pay for it") (driven by the health economics concept of self-interest)

One could point the finger at providers of care for the high cost of healthcare in the U.S. as well as the inconsistent quality, but the real culprit historically has been the healthcare payers, and specifically the 800 lb. gorilla Medicare.

As noted above, Medicare's payment policies and regulations have played a major role in shaping our healthcare system.

As we learned from health economics, providers of care are rational beings and, like decision-makers in other industries outside of healthcare, they will make decisions from a self-interest perspective that is best for their organizations. This applies to both for-profit and non-profit entities, since if there is "no margin, there is no mission."

If we want to evolve our healthcare system to be more value-based we need to start with substantial changes to Medicare's payment policies and regulations. We cannot have a hands-off approach to Medicare. While there has been much rhetoric relating to Medicare transforming its payment system to be value-based, the sad fact is that it has been mostly rhetoric.

We need to get beyond pilot programs and implement real payment reform to create real financial incentives for providers to transform their organizations and services to be value-based.

About the author:

Tom is the Director of the Health Care MBA program and a professor of health economics for Baldwin Wallace University in Cleveland, Ohio. He teaches and speaks on health policy and finance issues at the regional and national level. Tom writes a healthcare blog on LinkedIn which is also e-mailed to readers on a monthly basis. Subscribe here

Tom is the Director of the Health Care MBA program and a professor of health economics for Baldwin Wallace University in Cleveland, Ohio. He teaches and speaks on health policy and finance issues at the regional and national level. Tom writes a healthcare blog on LinkedIn which is also e-mailed to readers on a monthly basis. Subscribe here