With effective dates looming, ASC 606 implementation readiness is top of list for many executives.

All entities that enter into contracts with customers will need to be prepared. Effective dates are set to begin after December 15, 2017 for public entities and after December 15, 2018 for nonpublic entities. The intent of the new Accounting Standards Update (ASU) No. 2014-09 is to establish a core principle for revenue recognition across all industries, both domestically and internationally, with converged guidance from the Financial Accounting Standards Board (FASB) and the International Accounting Standards Board (IASB).

Revenue, as a measure of performance, is used in comparative analysis, risk assessment, and other business venture due diligence. By making revenue recognition consistent, the new standards will help users of financial statements understand the nature, amount, timing, and uncertainty of revenue and cash flows arising from contracts with customers.

Health care providers should understand not only what rules are changing, but also how the updated standards may impact financial modeling and reporting. Detailed attention should be given to the rules' impact on net patient service revenue given the variety of contractual arrangements present in this revenue stream. For help understanding ASC 606 unique impact on healthcare, The American Institute of CPAs (AICPA) Health care Entities Revenue Recognition Task Force is one of 16 industry task forces created to identify potential implementation issues and provide guidance.

By way of an overview of the New Standard on Revenue Recognition, please reference FASB ASC Topic 606 Fast Facts below. Another excellent resource for Healthcare Financial Management Association members is the article, Healthcare Revenue Recognition 5 Steps for Net Revenue Modeling and Reporting Considerations, published January 2017.

FASB ASC Topic 606 FAST FACTS

| Who | All entities that enter into contracts with customers. |

| What |

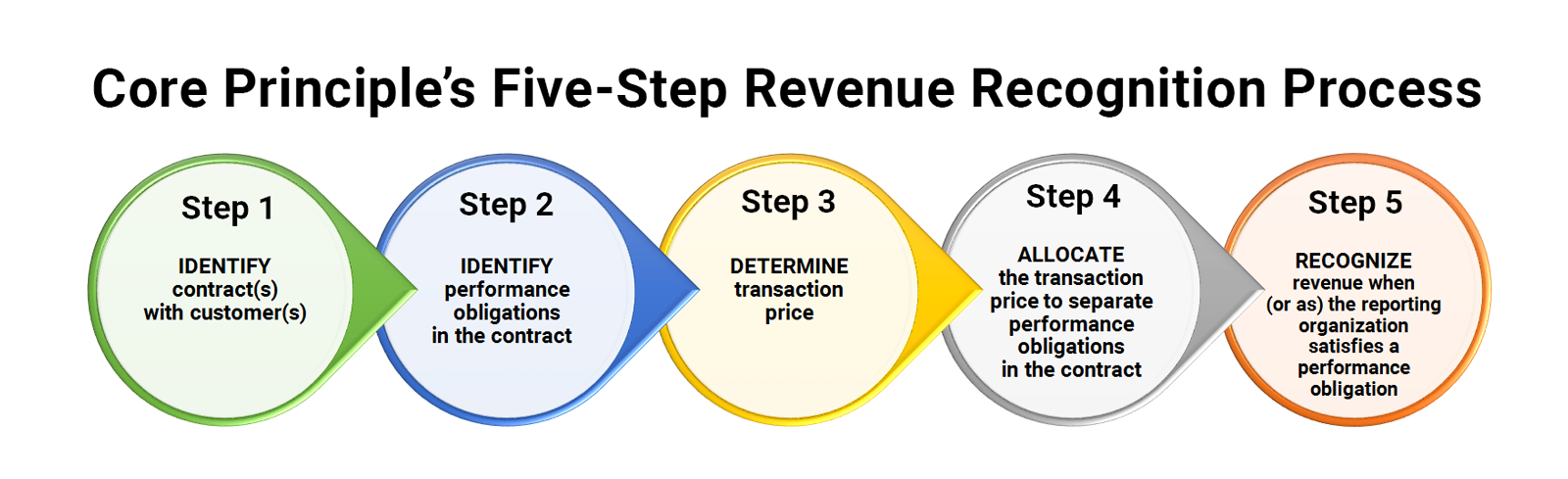

Financial Accounting Standards Board (FASB) New Standard on Revenue Recognition Accounting Standards Codification (ASC) Topic 606 (ASU 2014-09): Revenue from Contracts with Customers Core principle: recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. |

| When |

On 8/12/15, FASB decided to defer the effective date by one year. Public organizations should apply the new revenue standard to annual reporting periods beginning after December 15, 2017. Nonpublic organizations should apply the new revenue standard to annual reporting periods beginning after December 15, 2018. |

| Where | To help identify WHERE implementation challenges may be greatest for healthcare providers, please visit AICPA’s Health Care Entities Revenue Recognition Task Force landing page for implementation issue updates and guidance. |

| Why | Objective: Establish the principles to report useful information to users of financial statements about the nature, timing, and uncertainty of revenue from contracts with customers. |

| How | FASB ASC Topic 606 outlines for organizations the five steps to use to determine HOW to recognize revenue from customers. |

Given healthcare’s variety of contractual arrangements with customers to provide services and goods (performance obligations), the numerous ways that entities are paid may make implementation a challenge. Add to that the industry’s transition to value-based reimbursement, and healthcare providers find themselves facing additional complexity when executing revenue recognition step #3, determining the transaction price.

Companies will need to choose which method they will use to comply with the new FASB standard. There are two transition methods: Full Retrospective and Modified Retrospective. Some companies may opt to restate sales for the required number of prior years, while other companies may choose the modified compliance approach, applying the new rules only to existing and future contracts as of the effective date. Regardless of which method chosen, a significant amount of dual reporting will be required—reporting both under the old Generally Accepted Accounting Principles (GAAP) and the new incorporating FASB ASC Topic 606.

Whether public or nonpublic, affected companies should begin preparing now for the adoption of the new requirements. Inventorying revenue streams—developing reporting formulas for every class or type of contract—and evaluating how revenue will be affected by the new rules is a great place start. ASC 606 countdown has begun!